|

|

A few treats about real estate

& technology on a Friday

|

|

|

|

Welcome to the inaugural edition of S’mores - Bonfire's snack-bite digest of mind-bending real estate, finance, or blockchain stats, quotes, and stories.

Bonfire has evolved into an Investor Club targeting 8-12 curated commercial real estate deals per year that can achieve 15% annual IRRs that have minimum buy-ins of $1,000 (instead of typical minimums of $100K).

If you are interested in receiving these newsletters

and/or finding out about investment opportunities,

please hit reply to this email and let us know.

|

|

|

|

|

|

|

|

|

|

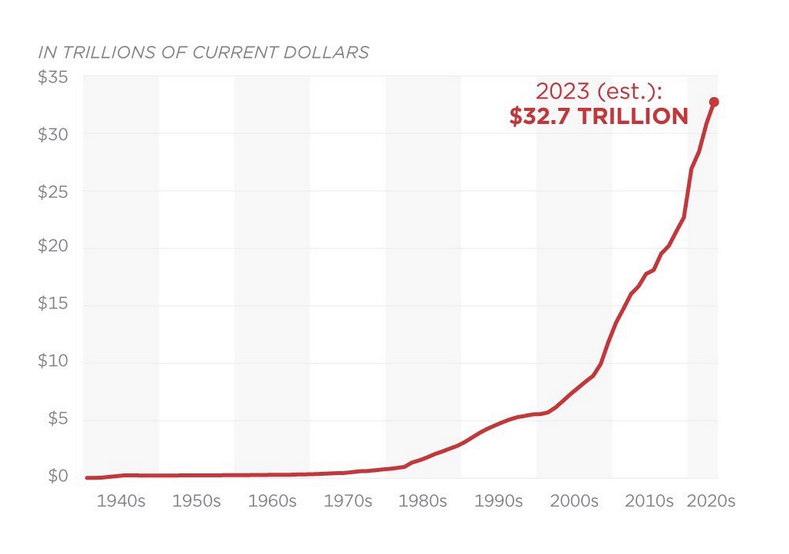

With Fitch downgrading the USA’s credit rating from AAA to AA+, it is worth considering how we got here. It took the U.S 205 years to add the first $1 trillion in debt. We just did it again in two months since the debt ceiling deal. No bueno.

Additional resources: This piece from Lynn Alden’s provides a great analysis of the implications of all of this debt. It’s a long read but worth it. Additional resources: This piece from Lynn Alden’s provides a great analysis of the implications of all of this debt. It’s a long read but worth it.

| |

|

|

|

|

|

|

|

San Francisco has 30 million square feet of vacant office space compared to less than 10 million square feet only four years ago. |

|

Bonfire's Question: With all of these vacant offices combined with an acute national housing shortage, is it a viable strategy to convert offices into apartments? Check out Loopnet’s take on the pros and cons of office reconversion and Silversteins’ first office-to-apartment conversion project.

| |

|

|

|

|

|

|

|

“If Taylor Swift were an economy, she’d be bigger than 50 countries.”

Taylor Swift’s current tour, spanning 53 U.S. cities and 131 global locations, will generate ticket sales expected to surpass $1 billion and $4.6 billion in consumer spending in the U.S. alone. What does Swift’s tour have to do with real estate? Find out here. |

|

|

|

|

|

Bonfire will soon launch our next asset. We are targeting around

10 curated investments per year

with targeted 15% annual IRRs

from A+ sponsors. If you would

like to find out about our

investment opportunities either

hit "reply" or sign up for a free

account here.

| |

|

|

|

Have a wonderful weekend!

Joshua Kagan, Co-Founder, Bonfire

Forwarded this newsletter? Sign up here

| |

|

|

|

|

|

|

|